For CEOs, reputation is directly linked to valuation, market access, regulatory resilience, and shareholder trust. For CMOs, reputation is the single biggest driver of brand preference, loyalty, and cultural influence.

Yet, most organizations still manage reputation through static surveys and one-dimensional indices that fail to capture its dynamic, multi-faceted nature.

Introducing Reputation Capital Intelligence (RCI) — the world's first AI-powered, predictive framework that quantifies reputation as a strategic asset.

RCI maps the critical levers of governance, trust, culture, and innovation to tangible business outcomes, enabling leaders to forecast the impact of their actions and drive measurable results.

Reputation Capital (RC) is the only dynamic, predictive, and ROI-driven framework that not only identifies the critical levers shaping reputation but also quantifies their direct financial and strategic impact. Unlike conventional reputation trackers—which are static, backward-looking, and one-dimensional surveys or indices—RCI offers a live, multi-layered dashboard that continuously maps governance, trust, culture, and innovation to tangible business outcomes.

With RCI, leaders gain a forward-looking, scenario-tested view of reputation, enabling them to detect risks early, capture opportunities faster, and strengthen their organization's most valuable intangible asset in today's rapidly evolving marketplace.

Direct correlation between reputation index points and market cap swings (2–3%). Evidence-based forecasting of how governance, ESG, and trust indicators influence investor confidence.

RCI integrates into quarterly board reporting to demonstrate how reputation impacts shareholder value. Creates alignment between CFO, CEO, and IR teams with a measurable dashboard.

Detects reputation liabilities (governance lapses, compliance gaps, litigation exposure). Quantifies downside risk and provides a Crisis Mitigation Value-at-Risk (CM-VaR) model.

Aligns with OECD, SEBI, RBI, ESG, DPDP norms. Creates a reputational "buffer" with regulators and governments.

RCI evaluates brand-market trust fit for cross-border acquisitions. Provides predictive models for synergy risk in mergers (reputation dilution scenarios).

Connects reputation drivers (innovation, culture, advocacy) to purchase intent. Predictive analysis of price premium elasticity linked to trust.

Measures how strongly a brand shapes conversations in social, media, and cultural ecosystems. Tracks share of trust vs competitors in real time.

Demonstrates the financial return of campaigns on loyalty, advocacy, and repeat purchase. Links earned media & ESG campaigns to bottom-line metrics.

Heatmaps of real-time reputation risks in customer ecosystems. Proactive narrative-shaping tools powered by AI-driven insights.

Tracks internal reputation (employee trust, DEI scores, Glassdoor-like sentiment). Demonstrates how culture contributes to external reputation and talent acquisition advantage.

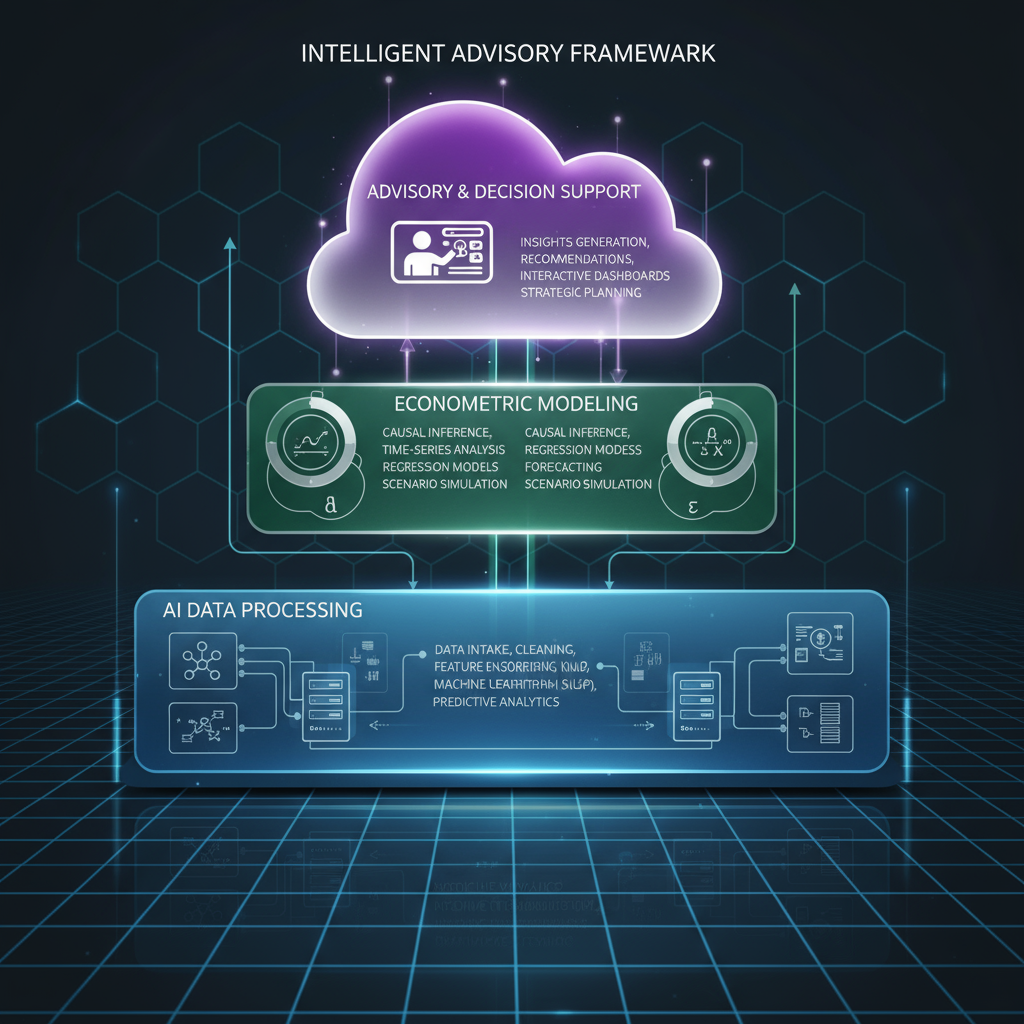

RCI functions on 3 layers:

NLP-powered sentiment analysis across 50M+ data points (media, investor calls, legal filings, ESG reports). Predictive algorithms model trust erosion speed (TES) and advocacy velocity (AV).

Econometric modeling: Maps governance, ESG, brand advocacy to EPS, P/E ratios, and fundraising success. Boardroom KPIs: RSI (Reputation Score Index), RAR (Reputation at Risk), CIQ (Cultural Influence Quotient).

Quarterly Reputation Capital Reports for boards and CMOs. Scenario simulations: "What if" testing for PR crises, regulatory scrutiny, or ESG controversies. Playbooks for capital allocation: Show where investment in reputation yields highest ROI.

In today's dynamic market, reputation is your most valuable intangible asset. Schedule a strategy session with our team to explore how Reputation Capital Intelligence can help you forecast the impact of your actions and drive tangible business results.

Schedule a Session"Reputation is the strongest currency — we convert it into measurable capital."

– Pradeep Kumar, CMO, Young Thames LLP